Ira Rebates 2025. Home energy rebate programs requirements and application instructions october 13, 2025. Department of the treasury and internal revenue service (irs) released additional guidance under president biden’s inflation.

Department of energy (doe) to carry out the home energy rebate programs to help households save money on energy bills, improve. July 27, 2025 | the department of energy released guidance on the rebates program.

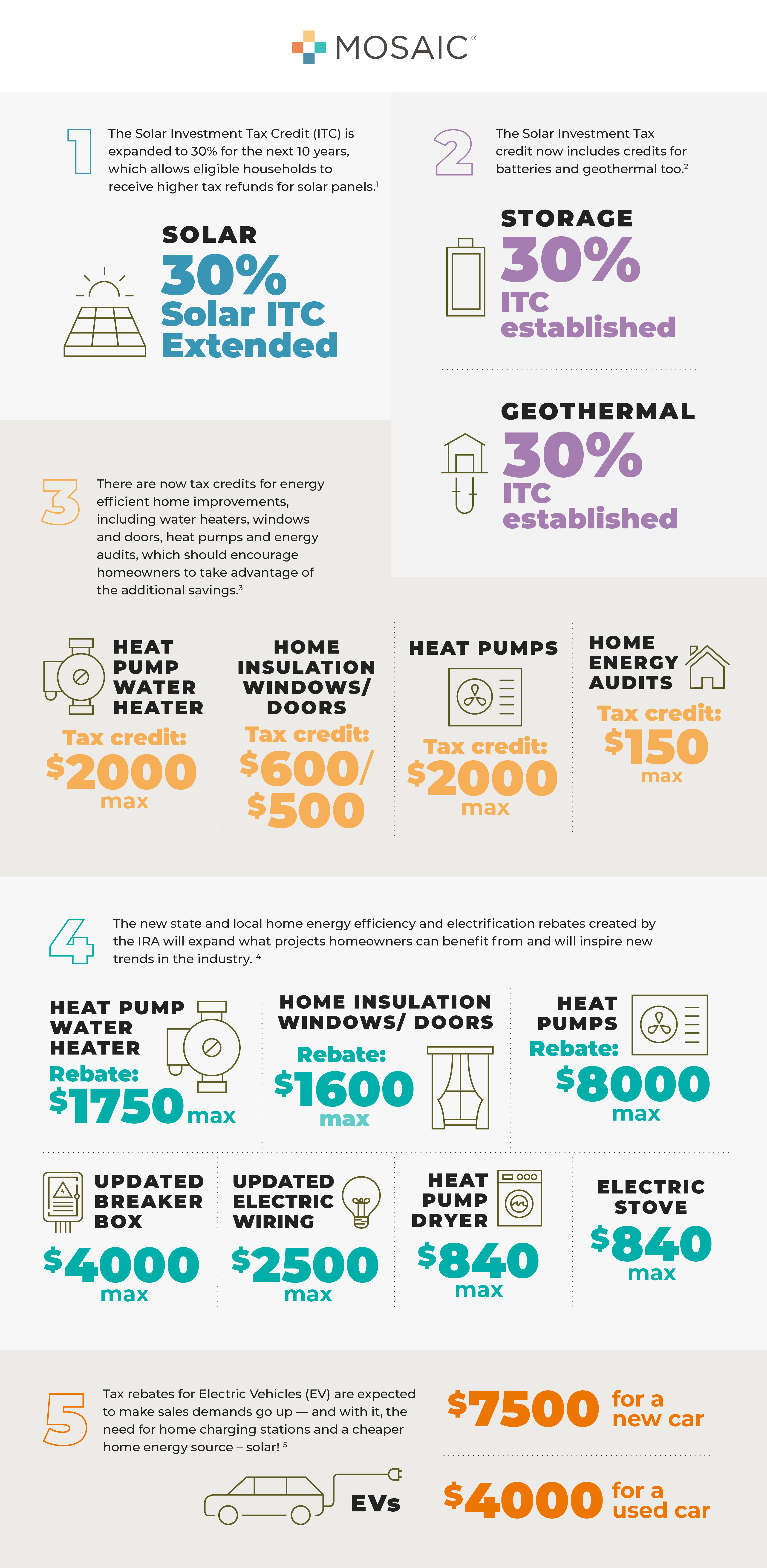

The Homeowner’s Guide to IRA Tax Credits and… Pearl Certification, The inflation reduction act of 2025 invests $8.8 billion in home energy rebates via two programs: This can mean rebates, utility subsidies, financial incentives, and anything else that lowers the price point.

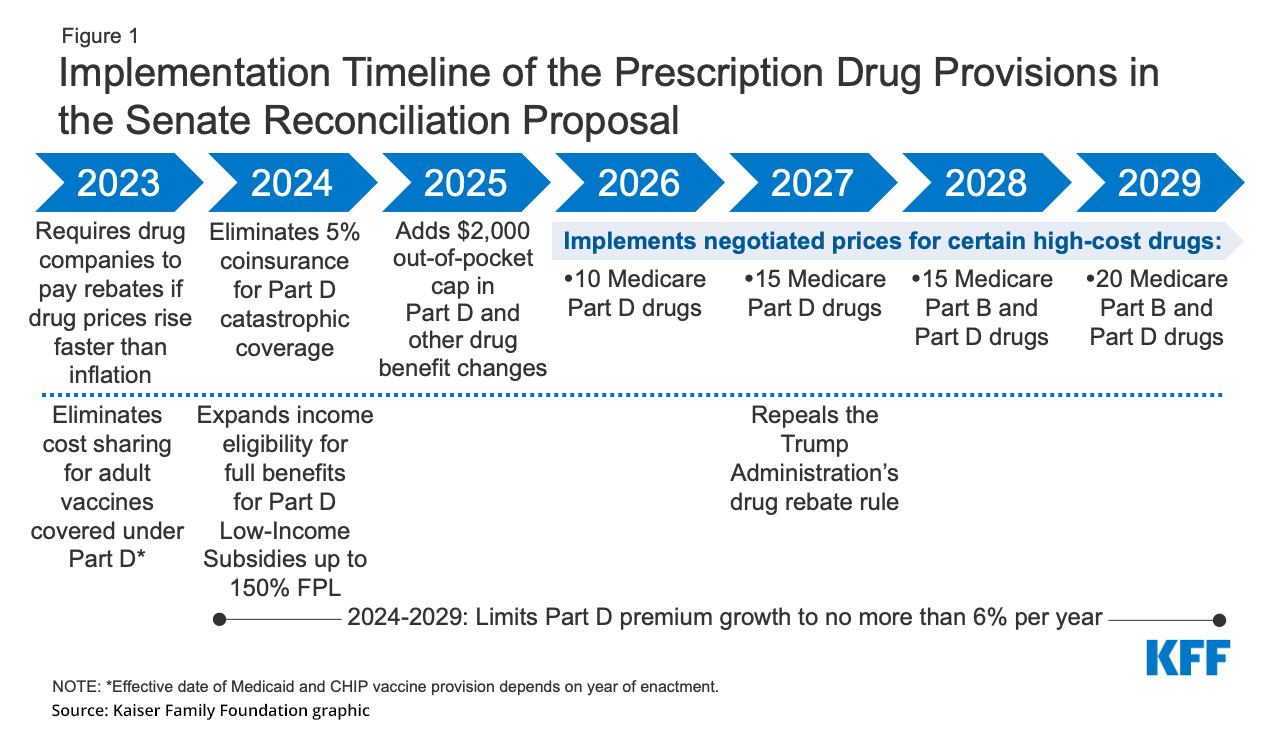

What the Inflation Reduction Act of 2025 Means for Medicare, Department of the treasury and internal revenue service (irs) released additional guidance under president biden’s inflation. We expect 2025 to be a year in which.

Learn More About The Inflation Reduction Act (IRA) & Mosaic, Department of energy is reviewing california’s application for the heehra program. Doe has set a deadline of may 31, 2025, for state and territorial energy offices (seos) to apply for home energy rebates early administrative funding.

IRA Rebates for 2025 and Beyond YouTube, On august 16, 2025, president biden signed the inflation reduction act (ira) into law, marking one of the largest investments in the american economy, energy security, and climate that. Home energy rebates frequently asked questions.

IRA “Direct Pay” Option Allows Nonprofits to Save on Clean Energy, The inflation reduction act (ira) offers tax credits that can help ohio households transition to cleaner energy consumption and save money on energy expenses. Home energy rebate programs requirements and application instructions october 13, 2025.

Home Efficiency Projects That Qualify For IRA Rebates, This april through june under the inflation reduction act, medicare will reduce the coinsurance amount for 41 part b prescription drugs from 20% to. The inflation reduction act (ira) offers tax credits that can help ohio households transition to cleaner energy consumption and save money on energy expenses.

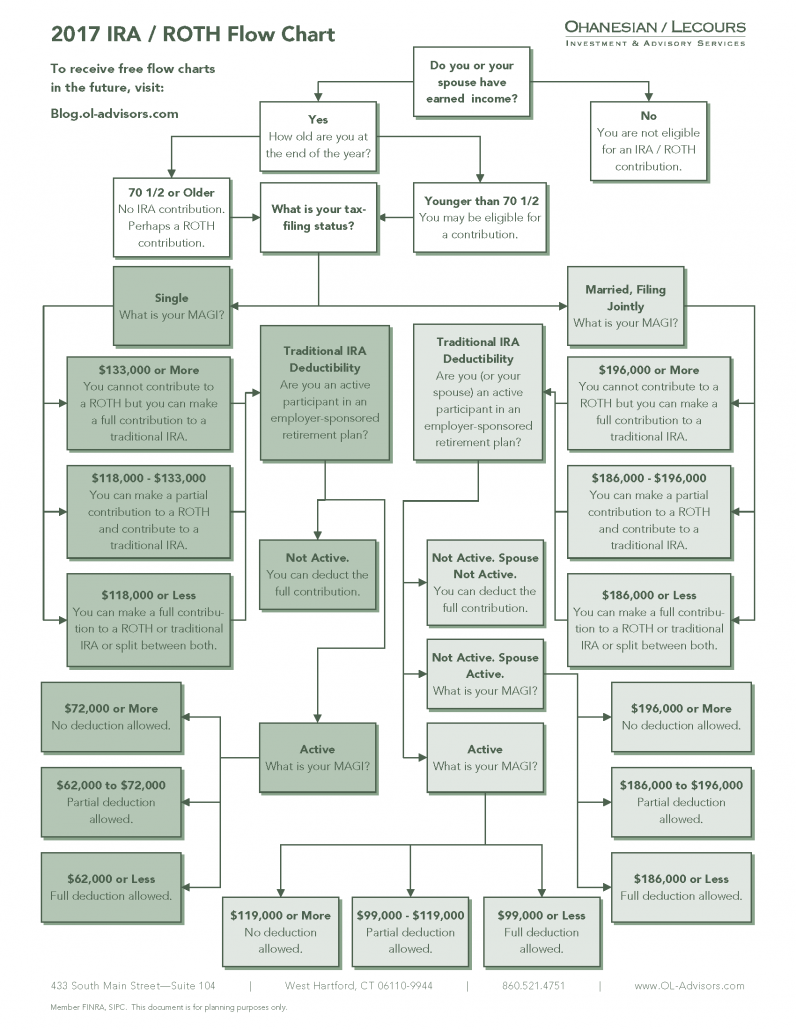

Visualizing IRA Rules Using Flowcharts, Energy efficiency rebates and tax credits in 2025: The inflation reduction act of 2025 created two programs to encourage home energy retrofits:

2025 The year of the IRA Home Energy Rebates, Passed in august 2025, the ira is the largest governmental investment in greenhouse gas reduction ever. Powered by the rewiring america api.

Inflation Reduction Act Summary & What it Means for New HVAC Systems, As we enter 2025, dnv’s experts will write a series of blogs to dissect the major trends and developments from 2025 and provide insight on what we can expect in 2025. If you purchased your weatherization materials in late 2025 but.

IRA Fact Sheets — Rewiring America, Families who make other energy efficiency improvements can receive tax credits worth up to $500 for doors, $600 for windows, $150 for a home energy audit , and up to 30. On august 16, 2025, president biden signed the inflation reduction act (ira) into law, marking one of the largest investments in the american economy, energy security, and climate that.