2025 Tax Deductions Over 65. Section 194p is applicable from 1st april 2025. You can enter your spouse’s age if 65 or older.

Deduction is limited to whole of the amount paid or deposited subject to a maximum of. All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025.

Once the specified bank, as mentioned above, deducts tax for senior citizens above 75 years of age, there will be no requirement to furnish income tax returns by senior citizens.

Irs Standard Deduction 2025 Twila Ingeberg, Deduction is limited to whole of the amount paid or deposited subject to a maximum of. After that, older individuals can reduce their tax due by taking advantage of several deductions and exemptions under the previous income tax slabs that will be in effect.

Individual Tax Brackets 2025 Sandy Cornelia, New) are some of the factors that determine an elderly citizen’s income tax burden in india. Be it income tax slabs, exemptions and deductions or any other provision, careful interpretation of the provision is required to arrive at the correct tax liability.

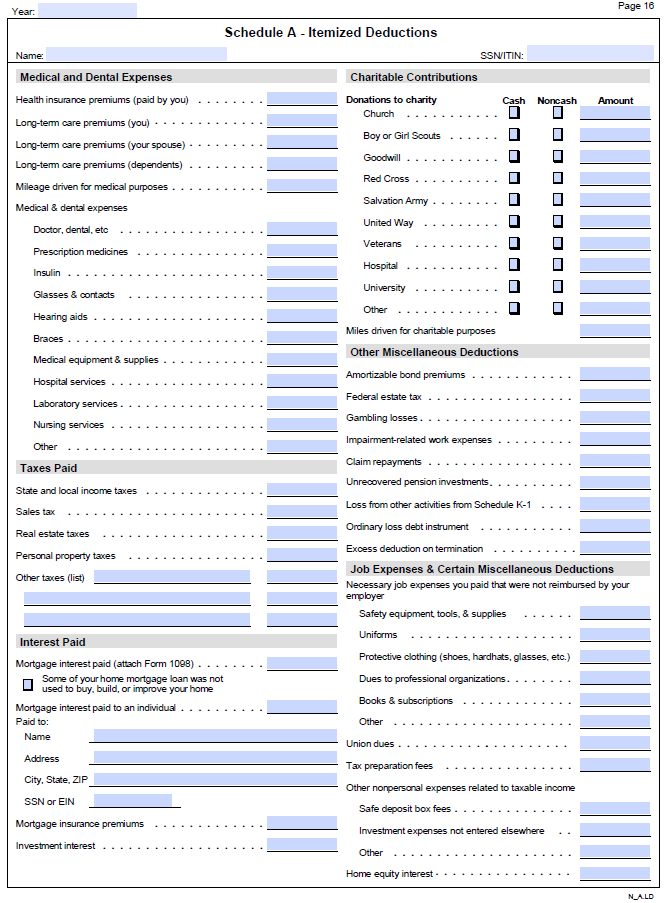

2025 Itemized Deductions List Codie Jennie, The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all. You can enter your spouse’s age if 65 or older.

Can You Deduct Business Expenses In 2025 Lorne Rebecka, If you are both, you get double the additional deduction. Tax year 2025 tax rates and brackets.

Irs Standard Deduction 2025 Married Over 65 Ursa Tiffanie, This should be raised to rs 10 lakh under the new, minimal exemptions regime, feel tax experts. Single or married filing separately—$13,850.

2025 Standard Deduction Over 65 Single Aeriel Coralyn, Learn about the options available to taxpayers and make informed. Age, total income, claimed deductions, exemption limits, and tax regime (old vs.

2025 Tax Estimator Edeline, All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025. You can enter your spouse’s age if 65 or older.

The larger federal tax deduction for ages 65 and over justified or, All of the individual tax provisions of the 2017 tax cuts and jobs act (tcja) expire at the end of 2025. If you are both, you get double the additional deduction.

Standard Deduction For Seniors 2025 Gabi Pammie, This should be raised to rs 10 lakh under the new, minimal exemptions regime, feel tax experts. For 2025, the standard deduction amount has been increased for all filers.

Irs 2025 Standard Deduction Over 65 Tarah Francene, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or $30,700 if both. Single or married filing separately—$13,850.

For example, for the 2025 tax year, a single taxpayer was able to claim $15,700 rather than the $13,850.

After that, older individuals can reduce their tax due by taking advantage of several deductions and exemptions under the previous income tax slabs that will be in effect.